POWER MARKETS

WEST Demand has been relatively moderate in this first full week of November as the weather has stayed mild. Consequently, Day Ahead prices for the month to date are averaging $26.34/MWh at Mid-C, $36.72/MWh at NP15, $29.65/MWh at SP15, tracking well under the final averages of roughly $70/MWh, $62/MWh, and $53/MWh, respectively, for November 2023. However, prices can be expected to rise over the course of this month and into December as the usual changes in weather drive the usual surge in demand and hydropower becomes scarcer because of ongoing droughts in the Pacific Northwest.

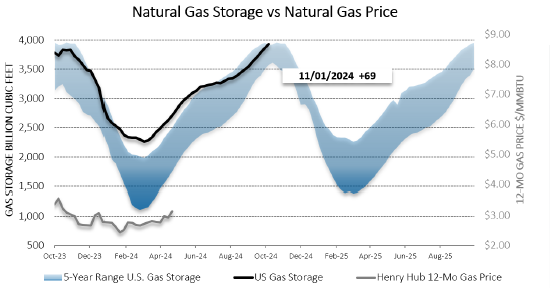

ERCOT To the delight of consumers, the average of 7x24 real-time prices has been unimpressive at less than $24/MWh since the start of the month, held in check by unseasonably pleasant weather, growing renewable capacity, and low natural gas prices. Of course, that figure encompasses the higher-risk sundown hours, which have shifted up by an hour to HE18-HE19 with the resumption of Standard Time and averaged around $60/MWh so far. Real-time prices should find some support early next week from a drop in wind output forecasted for one or two days, especially in those sundown hours. In the forward-term market, prices for CY 7x24 strips have climbed by approximately $1/MWh since last week, the biggest move occurring on Wednesday in response to the Presidential election. Strips down the curve remain in the mid-to-upper $40s/MWh, still considerably below where they started this summer.

EAST Day Ahead prices have been lower than Real Time prices in all regions this week, averaging $31.61/MWh in PJM, $29.70/MWh in NYISO, and $36.04/MWh in ISO-NE’s WCMASS against Real Time averages of $33.06/MWh, $31.90/MWh, and $43.70/MWh, respectively. Demand under-clearance in the Day Ahead market, minimal wind generation, and diminished behind-the-meter output due to showers and cloud cover account for that especially large spread of nearly $8/MWh in ISO-NE. The fall outage season now ending and unseasonably mild temperatures persisting, both demand and prices are expected to stay bearish next week.