POWER MARKETS

WEST

Over the weekend, while the weather was warmer and both wind and hydro generation were strong, spot prices

dropped sharply, especially in Mid-C, where they fell by roughly $20/MWh from December 6 through December 7

before slipping by another $10/MWh to $29/MWh on Monday. Since then, heating demand has spiked as overnight

temperatures have nosedived, and spot prices have risen throughout this week. The Day Ahead averages for the

month to date now sit at $48.29/MWh in Mid-C, $51.71/MWh in NP15, and $44.16/MWh in SP15 at the time of this

writing. Despite the rise in demand, prices are expected to stay relative-ly flat next week as renewables

look reliable and the 15-day weather forecast indicates warmer conditions.

ERCOT Real-time prices have averaged around $25-$30/MWh so

far in December, thanks to weather that has stayed relatively mild despite brief spells of freezing

temperatures. Relatively healthy renewable output on colder days has ensured ample generation reserves to meet

morning and evening peaks, and these conditions are forecasted to persist through the middle of next week. In

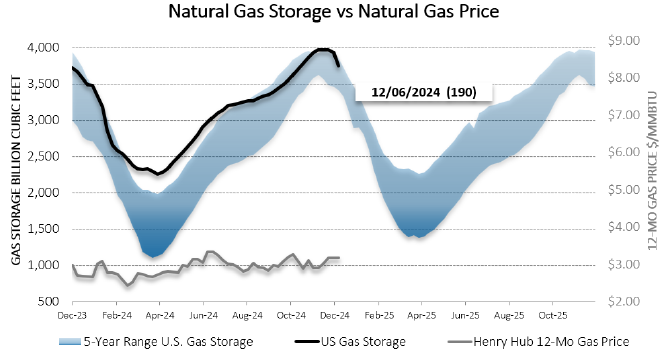

the term market, forward curves continue to move higher alongside natural gas; all calendar-year strips down the

curve are up by roughly $1/MWh since last week and have breached $50/MWh again.

EAST Temperatures that reached the 60s in Boston and New York on

Wednesday have low-ered prices across all regions this week despite rising natural gas prices. While Day Ahead

prices are averaging $36.78/MWh in PJM, $56.91/MWh in NYISO, and $62.76/MWh in ISO-NE’s WCMASS this week, Real

Time prices are around $34.12/MWh, $53.13/MWh, and $65.01/MWh, respectively. Next week should start warmer than

normal, featuring highs ranging from the mid-40s to the mid-50s, before cooling down later in the week, likely

keeping prices moder-ate.