POWER MARKETS

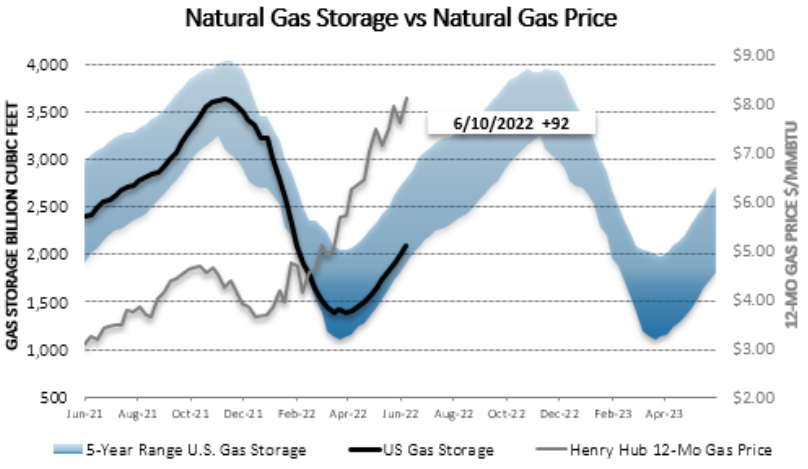

WEST The strong precipitation over the past few months in the Pacific Northwest has paid off in above-average hydro generation throughout the first half of June and significantly suppressed the Day Ahead LMP in Mid-C. This week, Day Ahead prices in Mid-C have averaged around $9.00/MWh, substantially less than the average weekly settle in SP15, which has been around $71/MWh. In the forward market, news of the Freeport LNG facility’s closure for three months has pulled not only natural gas prices but also spot prices for Bal-2022 down significantly.

ERCOT Despite both record peak loads due to blistering heat across the state and spot natural gas prices over $7/MMBtu, 7x24 real-time prices have been relatively low this week in all zones except Houston. Whereas strong wind and solar generation in the West has kept real-time prices between $40/MWh and $60/MWh in all of the other zones, Houston’s average has hovered right around $100/MWh as its outages have increased from 2,500 MW to 4,000 MW. Over in the term market, forward prices are down from last week on lower NG prices. Prompt 12-month 7x24 prices retreated by approximately $10/MWh on news that the Freeport LNG plant will likely not return to full service until the end of the year, but they have since regained $3/MWh as NG has partially rebounded.

EAST Summer is off to a strong start across the PJM footprint. The Real Time on-peak average in the Western Hub so far this week is $261.01/MWh. Amid near-record heat across the Midwest, demand has increased much more in PJM than in NYISO and ISO-NE. Consequently, Real-Time prices have blown up in the evening hours and produced large negative DART spreads. In Dayton, for example, Day Ahead trails Real Time by an average of $60.68/MWh.