POWER MARKETS

WEST This month’s skyrocketing spot prices persist. As temperatures in the Pacific Northwest have averaged around 10 degrees below normal over the past month and a half and curtailed snowmelt in the upper elevations, the Snow Water Equivalent level in the Pacific Northwest has blown up to 157% of normal. Snowmelt has started to increase and, in concert with recent rainfall, should augment flexible generation over the nightly ramp to ease spot prices, although fish spill restrictions have limited the amount of water allowed through turbines during spring.

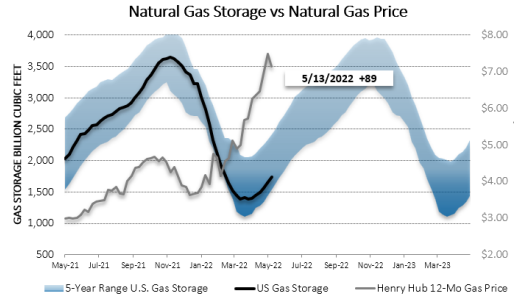

ERCOT Volatility is the theme in the real-time market, where 7x24 prices are averaging only $125-$150/MWh this week after averaging more than $500/MWh last Friday afternoon amid excessive loads contending with abnormally high temperatures and an unexpected loss of 3,000 MW of generation, which together pushed prices near the $5000/MWh cap that day. Next week, the state should enjoy some much needed rain, which should provide some relative stability at least for a while. Meanwhile, despite an increase in the prompt 12-month natural gas strip, term prices have actually retreated since last week; the prompt 12-month strip has fallen by approximately $3/MWh.

EAST Beginning Friday and lasting through Sunday, a brief but extreme heatwave throughout the eastern PJM region, NYISO, and ISO-NE with temperatures projected in the 90s should drive LMP averages well above $150/MWh. More seasonable temperatures should return and lower LMPs next week.