POWER MARKETS

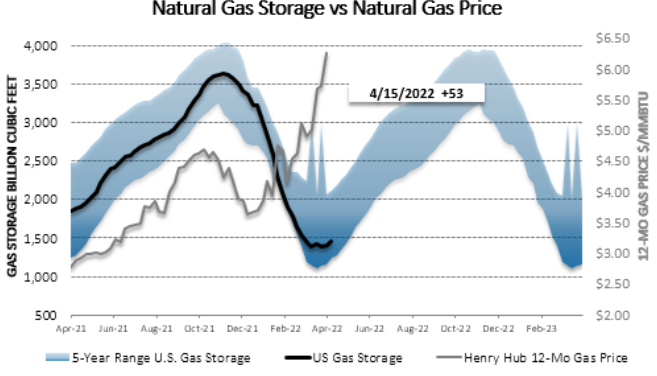

WEST Whereas, over the past five years, the Day Ahead averages for the month of April were around $23.50/MWh and $17.50/MWh in SP15 and Mid-C, respectively, they are more than double those figures so far this April at $54.25/MWh and $66.50/MWh. The strong spot prices continue to reflect the runaway rise in natural gas spot prices, which is driving up the marginal cost of power in the West. In the term market, forward prices are still trading in a volatile manner in response to large moves in the NYMEX forward curve.

ERCOT The impressive rally in natural gas futures continues to ripple through term prices, although the impact has been felt mainly in the front of the curve this week. The rally has come so far so fast that some may think a bit of retracement is due in the front of the curve. Amid the strong gas prices and current high-drought conditions in South and West Texas, summer peak prices are around $150-$160/MWh. Meanwhile, real-time prices for the month are in the $50-$60/MWh range, led by the Houston Load Zone. The ORDC adder for the month is just over $3.50/MWh.

EAST Compared with last week’s prints, prices have stayed relatively stable. In all of the main hubs in PJM, MISO, and NYISO, averages are in the low $70s/MWh for Day Ahead and spanning the high $60s/MWh to mid-$70s/MWh for Real Time. ISO-NE is again the outlier, although, this time, its Day Ahead and Real Time averages are under those of the other ISOs at $63/MWh and $59/MWh, respectively.