POWER MARKETS

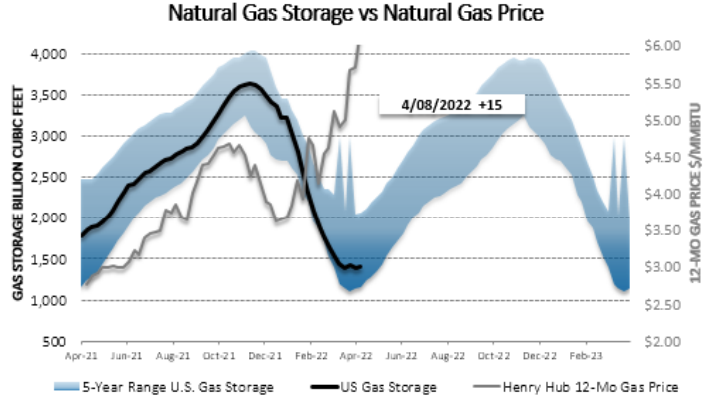

WEST Throughout the first half of April, Day Ahead prices been strong, nourished not only by high spot prices for natural gas but also by unseasonable temperatures. This week’s unusual cold in the Pacific Northwest has actually lifted spot prices in Mid-C above those in CAISO: Since last Friday, Day Ahead averages are around $67/MWh in Mid-C and $54/MWh in SP15. In the term market, forward prices throughout the region also continue to climb because of the unrelenting growth in the NYMEX forward curve.

ERCOT Term prices continue to climb in the front of the curve, mainly because term prices for natural gas keep doing so as well. Indeed, BY 2022 is in the mid-$80s/MWh, $10/MWh higher than last week, and CY 2023 is up by $5-$6/MWh. Meanwhile, real-time prices remain firm as the MTD averages in the Houston Load Zone and South Load Zone are above $60/MWh amid seasonal outages, line congestion, and variability in output from renewable generators. Although temperatures are projected to be normal to below normal over the next 10 days, they nonetheless have been rising in a sign of the beginnings of cooling season, which will start to magnify demand.

EAST Increases in natural gas prices and maintenance-related generator outages have pushed index prices above seasonal norms and into the $70s/MWh this week. Prices may stay elevated into next week as cold weather moves across the Midwest and through the Northeast.