POWER MARKETS

WEST Throughout March, Day Ahead prices averaged around $41.50/MWh in SP15 and $33.75/MWh in Mid-C. The lower figure in Mid-C was driven by a combination of strong hydro generation and light demand. In the forward market, prices continue to swell on the back of a strong rise in the NYMEX forward market, which has persisted throughout the month.

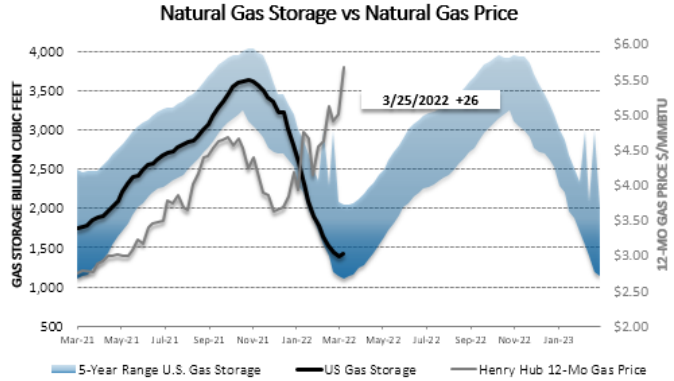

ERCOT Term prices continue to rise throughout the curve, buoyed again by surging natural gas prices. Indeed, CY 2023 in the North Load Zone has increased by $10-$15/MWh since the beginning of February. In contrast, real-time prices have been relatively immune to the same influence; depending on the zone, March prices have averaged in the mid-$30s/MWh. Spot prices are projected to reach the high $50s/MWh in April as maintenance season begins while output from wind units varies. The ORDC adder for March is minimal as well.

EAST After a three-week lull, both Day Ahead and Real Time have picked back up, especially in New York and New England. The latest storm to hit the Northeast not only raised demand beyond expectations but also cut exports, forcing the deployment of hydro assets with an insufficient number of oil-fueled units in the supply stack. While Day Ahead prices have jumped by roughly $30/MWh from last week, Real Time is up by $52/MWh on average.