POWER MARKETS

WEST Day Ahead prices have averaged around $55/MWh in CAISO and $44/MWh in Mid-C so far in January; strong spot hydro generation in the Pacific Northwest over the last two weeks has kept the LMP in Mid-C below that of CAISO. A strong developing West Coast ridge should make most of California relatively warm and dry over the next few weeks, possibly interrupting snowpack buildup. In the forward market, projections of cold weather back east have raised NYMEX prices and, in turn, the 2022 curve in the West over the past few days

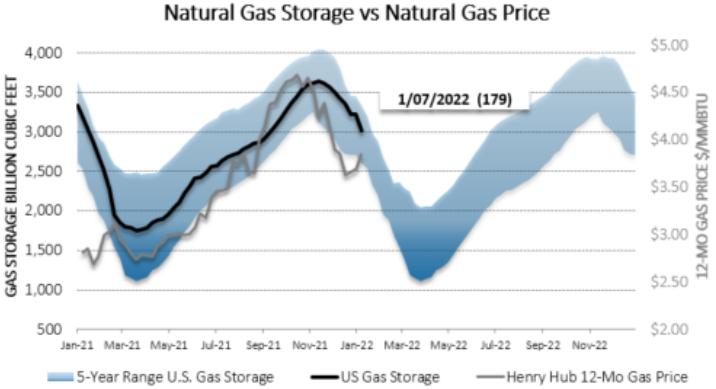

ERCOT Despite one morning of freezing weather and a high load ramp, which yielded an average daily price over $60/MWh, relatively mild conditions during the rest of the week have produced a real-time average around only $30/MWh for the week. Considerable uncertainty regarding weather forecasts toward the end of January and early February is causing a lot of volatility in short-term forward markets. Consequently, 7x24 prices for the remainder of January have made large moves, climbing by $30/MWh to $80/MWh yesterday before retreating to $60/MWh today. Despite that cooldown, bal-month and real-time price volatility is expected to increase dramatically over the next couple of weeks, depending on upcoming weather projections. Forward prices have also rallied on the heels of developments in the natural gas market as below-normal temperatures forecasted for the northeastern U.S. over at least the next couple of weeks have raised prices for CY22 and CY24 by more than $4/MWh and $2/MWh, respectively, since last week.

EAST Triple-digit prices throughout ISO-NE and NYISO are a byproduct of the regional cold snap. Day Ahead prices have increased by as much as $95/MWh since last week, and Real Time prices have climbed by $70/MWh. In ISO-NE and NYISO, Day Ahead is averaging $130-$140/MWh while Real Time is settling around $120-$140/MWh. PJM and MISO have not reacted as dramatically to the frigid weather; their Day Ahead and Real Time markets are settling in the $60s/MWh.