WASTE GOING TO ENERGY, OR ENERGY GOING TO WASTE?

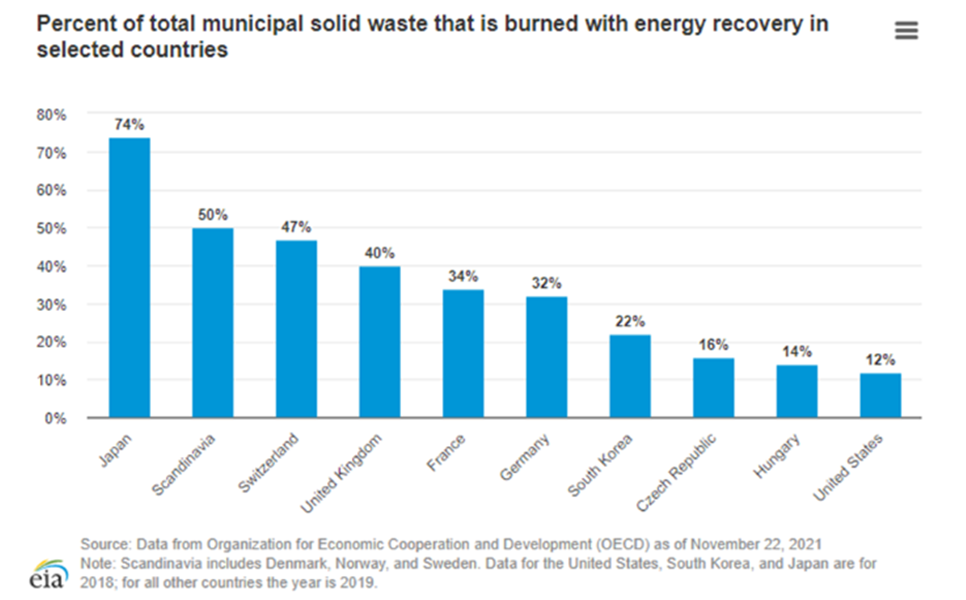

One cost-effective energy source currently harnessed in much of the developed world is municipal solid waste (MSW). As the U.S. Energy Information Administration (EIA) explains, MSW contains a mix of materials, both biogenic (such as paper, food scraps, and leaves) and non-biomass (such as plastics and petroleum-based products), that can be burned in specially equipped waste-to-energy (WTE) facilities to generate electricity. Compiling data from the Organization for Economic Cooperation and Development, the graph below from the EIA demonstrates the considerable extent to which many nations have embraced WTE not only to provide power but also to minimize the amount of MSW occupying their limited space. For example, Denmark, Norway, and Sweden converted half of their MSW into electricity in 2019, and Japan extracted energy from almost 75% of its refuse in 2018.

Last July, Statista’s Ian Tiseo projected the value of the global WTE market to reach $50.1 billion by 2027. With its vast landfills full of fuel for these generators, the U.S. arguably has the greatest potential for expansion of the technology, but its share of that pie may instead be shrinking. Although a total of 65 U.S. WTE power plants generated approximately 13.5 million MWh from 25 million tons of MSW in 2020, the U.S. was last in the EIA graph above, leaving 88% of its MSW untapped in 2018. Furthermore, Arlene Karidis of Waste360 observed that 12 WTE facilities in the U.S. closed between 2009 and 2019.”

The viability of WTE generation as a reliable energy source is undeniable, but, as Ms. Karidis notes, the gauntlet of low electricity prices, stringent permitting and regulatory demands, and public skepticism of its impact on the environment may prevent its growth in the U.S. Fortunately, the inclusion of WTE power alongside wind- and solar-generated electricity for certain states’ renewable energy credits (RECs), such as Maryland’s Tier 1 RECs, has improved that outlook. WTE generation already offers a way to achieve the popular objective of reducing landfills to prevent further blight in urban or marginalized areas. If the technology is ever upgraded to make the environment irrefutably cleaner, the energy sector will certainly not let it be thrown away.