POWER MARKETS

WESTHistorically strong natural gas stockpiles in California and the Pacific Northwest have kept index prices relatively soft. So far in February, Day Ahead prices have averaged around $31/MWh in CAISO and $24/MWh in Mid-C. However, in conjunction with an equipment failure on the West Coast pipeline reducing the amount of natural gas that can reach the Pacific Northwest, cold weather projected for that region could drive index prices higher over the weekend.

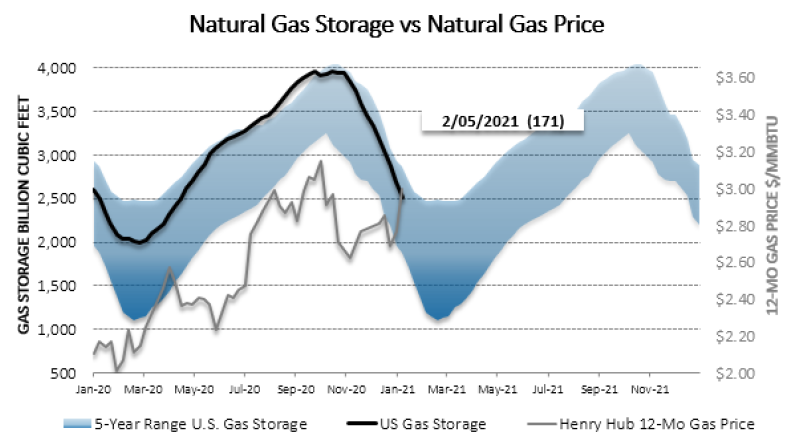

ERCOT The MTD average for real-time prices has settled in the mid $30s/MWh with the recent cold weather, and the persistent strength of natural gas prices has given a boost to term prices. The ORDC adder has also risen near $0.30/MWh, up from only a nickel a month ago. The market has responded to forecasts of a sharp blast of Arctic air sweeping through Texas, which should plunge temperatures into the low 20s on Monday and Tuesday. On-peak prices for next week are currently trading at $800/MWh as load is projected to approach record highs of just more than 70,000 MWh amid possibili-ties of decreased generation from reductions in gas supply due to potential shut-ins, potential curtailment of wind output in the West Load Zone, and depressed solar output due to the cloudy, wintry conditions.

EAST While the weather in ISO-NE and NYISO has been cold, prices have been hot. In ISO-NE’s Mass Hub, Day Ahead has averaged $92/MWh this week while Real Time has averaged $85/MWh. In NYISO’s Hudson Valley, the Day Ahead and Real Time averag-es are $63/MWh and $49/MWh, respectively. Prices at the main hubs in PJM and MISO have held steady despite the cold front in the East.