POWER MARKETS

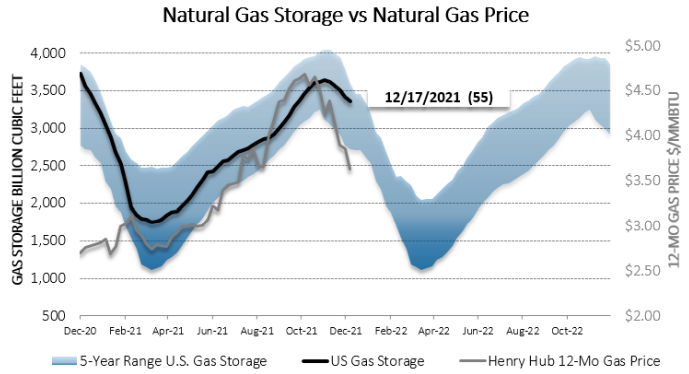

WEST Volatility remains strong in the regional hubs as the El Paso pipeline remains out of commission from the August explosion, depressing the amount of transport gas available to South ern California from the Permian Basin, and temperatures are expected to drop, increasing heating demand. Since the start of the week, the extreme cold has pushed the Q1 2022 forward curve higher by approximately $42/MWh in both CAISO and Mid-C. The rate of natural gas depletion will be extremely consequential in the near term.

EAST Bullish forward curves over the past year have proven accurate. On average, this month’s DALMPs and RTLMPs are 64% and 58% higher, respectively, than those of December 2020. In the Day Ahead market, the biggest movers since last year are ISO NE’s Mass Hub and MISO’s Indy Hub, which logged respective increases of $28/MWh and $22/MWh. PJM’s West Hub and NYISO’s Hudson Valley and NYC recorded more modest Day Ahead increases of roughly $15/MWh.