POWER MARKETS

WEST Above-average snowfall in the Sierra Nevada and Cascade ranges, due to this week’s powerful storm along the West Coast, has increased the 2022 Pacific North west Summer Water Supply Forecast by approximately 5% to 98% of normal. Consequently, the CY 2022 forward curve has fallen by roughly $2.00/MWh. The drop has been driven not only by the significant snowpack accumulation over past few days but also by spot natural gas and power prices lower than projected during the recent cold front.

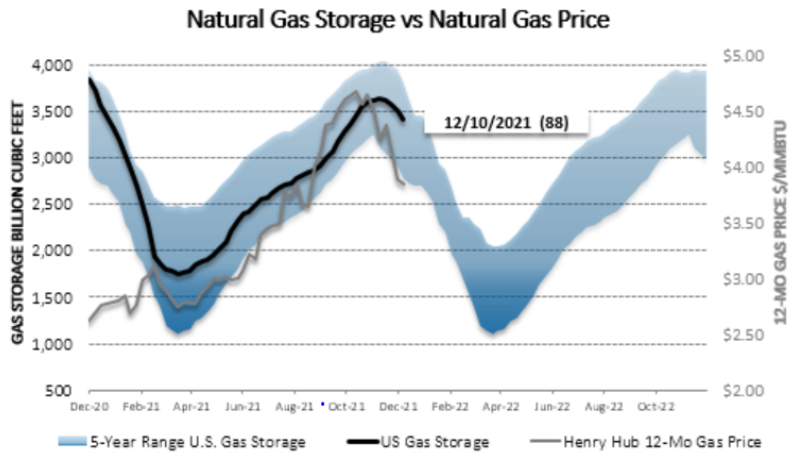

ERCOT Average 7x24 real-time prices have remained at or below $30/MWh across all zones this week as mild late-fall weather persists. In particular, prices in the West Load Zone and South Load Zone are averaging $15-$20/MWh because of strong wind output. Over the next couple of weeks, the pleasant conditions are largely expected to continue, so real-time price volatility should be limited. Meanwhile, for ward prices remain relatively constant from last week as natural gas appears to have established a floor for the time being after the steep selloff over the last couple of weeks.

EAST Prices have been dropping again this week amid unusually warm weather and underperforming demand. Surging imports are an additional factor lowering prices in ISO-NE, where the Day Ahead average has plunged by $17/MWh to $46/MWh and the DART spread is close to zero. In PJM West Hub, Day Ahead is averaging $38/MWh, $2/MWh less than Real Time. On the other hand, the Day Ahead average of $42/MWh in MISO’s Indy Hub is about $2/MWh higher than Real Time there.