POWER MARKETS

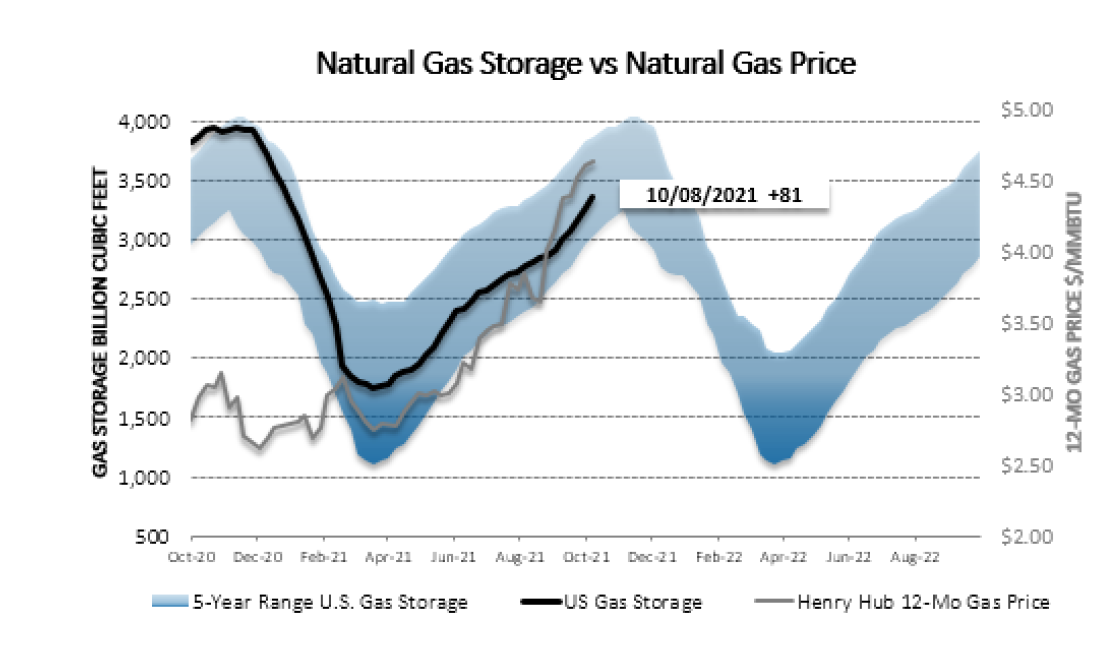

WEST So far this month, Day Ahead prices have ridden high on the backs of rising spot prices for natural gas, the fuel for typically the marginal unit of generation (i.e., the price-setting generator). Consequently, the Day Ahead averages over the first half of October are around $56/MWh and $64/MWh in SP15 and Mid-C, respectively. Meanwhile, the forward curve has been relatively flat over the past week as market participants keep a close eye on weather patterns for the upcoming winter.

ERCOT Real-time prices have remained strong this week, spurred on by the combination of unit outages and unseasonably high temperatures. MTD real-time averages are just below $60/MWh, nearly double those of both October 2020 and October 2019. Term prices are also sturdy, thanks primarily to the strength of the natural gas forward curve. The market is exhibiting significant backwardation, which is enabling consumers to avail themselves of greatly reduced hedge prices by locking in longer terms, as opposed to the standard 12-month term.

EAST Whereas, in the Midwest ISOs, prices are relatively unchanged from last week, elevated gas prices and unseasonable heat have pushed LMPs up in the Northeast. Day Ahead is averaging $5/MWh higher than last week with a minimal DART spread in ISO-NE’s Mass Hub. Over in NYISO, the Day Ahead averages for Hudson Valley and NYC are $7/MWh higher than last week and about $2.50/MWh above this week’s Real Time averages. Both Day Ahead and Real Time prices are in the low $60s/MWh in PJM’s West Hub and MISO’s Indy Hub.