POWER MARKETS

WEST Last Friday’s decision by SoCal Gas to increase pressure on line 4000 immediately will increase the amount of transport natural gas that will flow into the L.A. Basin through the Northern Zone by approximately 0.40 Bcf on a daily basis, roughly 12% of winter natural gas demand in Southern California. Consequently, fears of natural gas deficiencies during the upcoming winter have subsided, pushing down the SoCal Citygate forward price and, in turn, substantially lowering forward prices for Q1 and Q3 of 2022 this week.

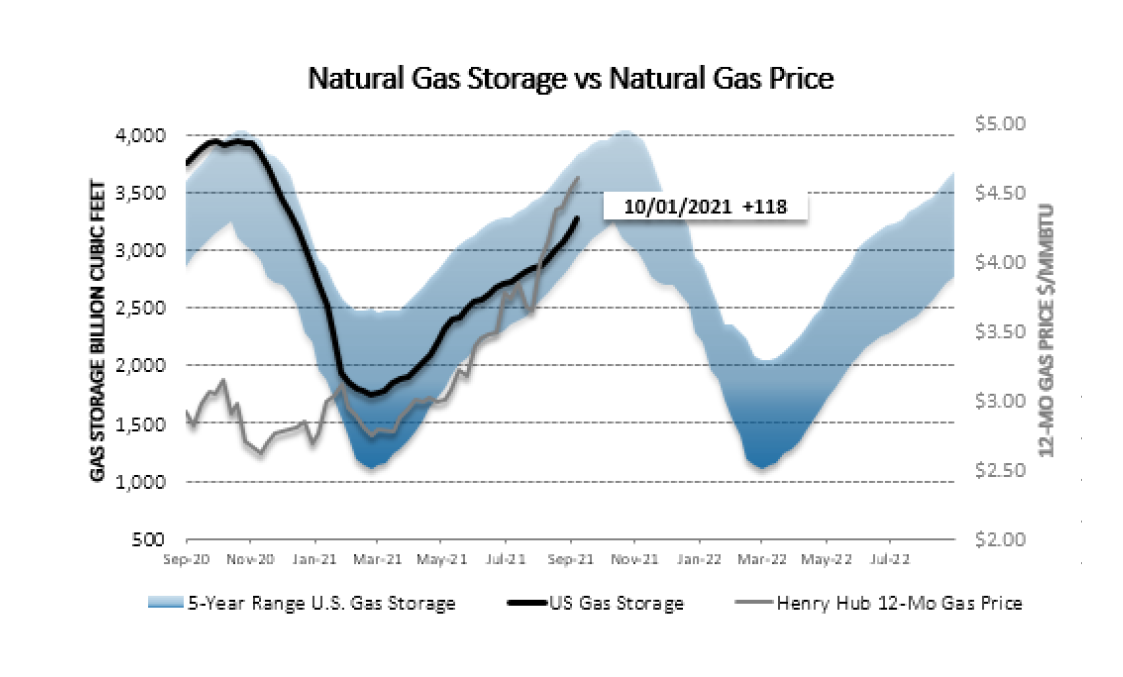

ERCOT Real-time 7x24 prices have gotten off to a strong start in October, this week averaging in the low $60s/MWh, around $25/MWh above last week, because of relatively strong loads for this time of year, extremely low wind output, 15,000 MW of generation on scheduled outage, and rising dispatch costs due to the ongoing rise in NG prices. This volatility is expected to continue over the shoulder months, although wind output should pick up for the next few days to provide temporary relief. In addition to generation outages, line outages during the shoulder months will likely yield some basis volatility. For the week, basis has averaged $0.50/MWh, $2.50/MWh, and $5.50/MWh across the Houston, South, and West Load Zones, respectively. In the forward market, prices also remain volatile, 7x24 CY22 trading in a $4/MWh swing for the week but ending relatively unchanged around $49/MWh. Strips for CY24 and beyond are up by more than $1/MWh.

EAST Prices are back up this week as lots of generation is out for planned maintenance, leaving a shorter supply stack available at this time of year. In PJM’s West Hub, Day Ahead prices are averaging $59/MWh, $16/MWh more than last week. Similarly, Real Time there is averaging $15/MWh higher at $62/MWh. ISO-NE’s Mass Hub is not showing as dramatic an increase, for both the Day Ahead and the Real Time averages are only $2/MWh greater than last week at $52/MWh and $49/MWh, respectively.