TRANSMISSION COSTS POISED TO INCREASE

Renewable generation continues to be the “alpha” in ongoing debates over how to modernize the country’s electric grids, but the “omega” of transmission cannot be overlooked. After all, to be constructed in enough volume to make a meaningful impact, renewable-energy facilities have tended to be located far from the regions that need or want them, so the necessity of moving those green electrons from generator to consumer speaks for itself. Newly appointed FERC Chairman Richard Glick certainly recognizes the importance of improving transmission policy to help states achieve their renewable-energy goals.

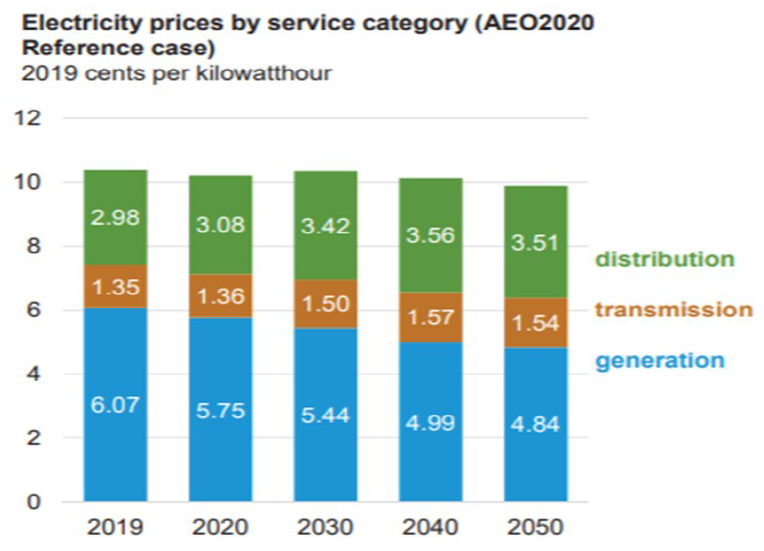

Of course, any discussion of improvements in the nation’s electricity transmission is bound to address costs. Many utilities have already had to raise their transmission rates over the last few years to provide needed upgrades to their grids, and that need will only increase as the green makeover expands. Indeed, the graph below from the U.S. Energy Information Administration shows that, whereas generation costs are expected to drop for decades to come, transmission costs are expected to continue to grow during that time.

As the new FERC carries out the new administration’s mission to remake the U.S. energy industry, further modernization of its transmission infrastructure may be mandated. Fortunately, Calpine Energy Solutions knows how best to accommodate this increasingly important risk factor in its customers’ energy purchases.