POWER MARKETS

WEST In California, imports keep coming in from other balancing authorities during the ramp hours as CAISO continues to send price signals during those hours. Both the Desert Southwest and the Pacific Northwest have been cooler than average, so CAISO has been able to soak up all of those spare megawatts. In other developments, outage season is approaching and, as evidenced by the drop in output at the Palo Verde nuclear facility in yesterday’s report from the U.S. Nuclear Regulatory Commission, may have already started.

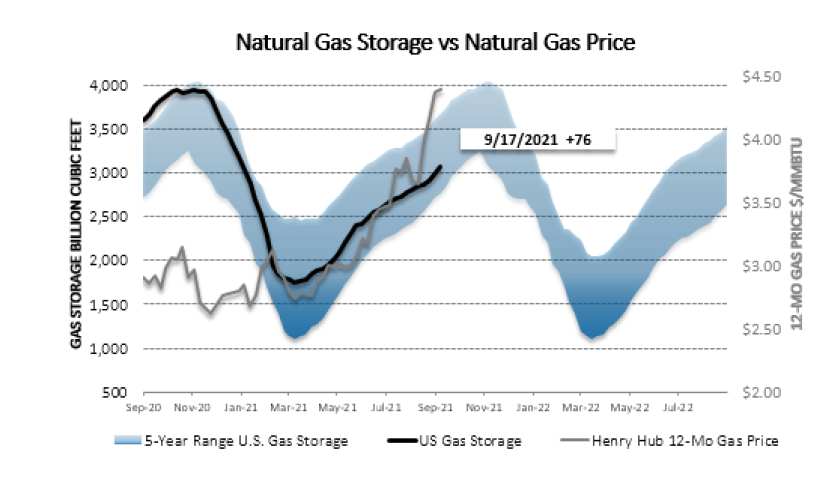

ERCOT Although real-time prices for the week are up, thanks to a few triple-digit prices in key intervals, averages for the month to date are in the low-to-mid $40s/MWh, still well above the $20s/MWh of last September. Term prices have been mixed this week as increases in the back of the curve have offset slight decreases in the front. In addition, the ORDC adder for September is under $0.10/MWh. Although the bulk of the cooling-focused load is done, high near-term gas prices due to low inventories are a new concern as generators take key winterization steps to mitigate the potential fallout of another event like this February in the coming winter.

EAST Prices are solid across the Northeast and Midwest as we move into autumn. So far this week, PJM West Hub has averaged $45.58/MWh, the highest at this hub for this same week in the past five years. DART spreads in MISO have been mostly positive this week because of a dip in demand in the Real Time market due to cooler weather. In ISO-NE, Mass Hub is averaging a strong $54.57/MWh.