POWER MARKETS

WEST Battery storage technology is critical to the current and future supply stack in California, for it makes the state’s grid more flexible and resilient, especially as intermittent renewable generation continues to grow. Indeed, battery storage in California currently peaks around 1,399 MW but is projected to exceed 2,000 MW by the end of this year. However, although many market participants believe that batteries will push a majority of natural gas-fired facilities out of the supply stack during the nightly ramp around 2024, others expect gas generators to stay the marginal unit of supply during off-peak hours, when fewer supply options are available. In the meantime, the rise in forward natural gas prices has raised forward off-peak prices but had minimal impact on forward on-peak prices.

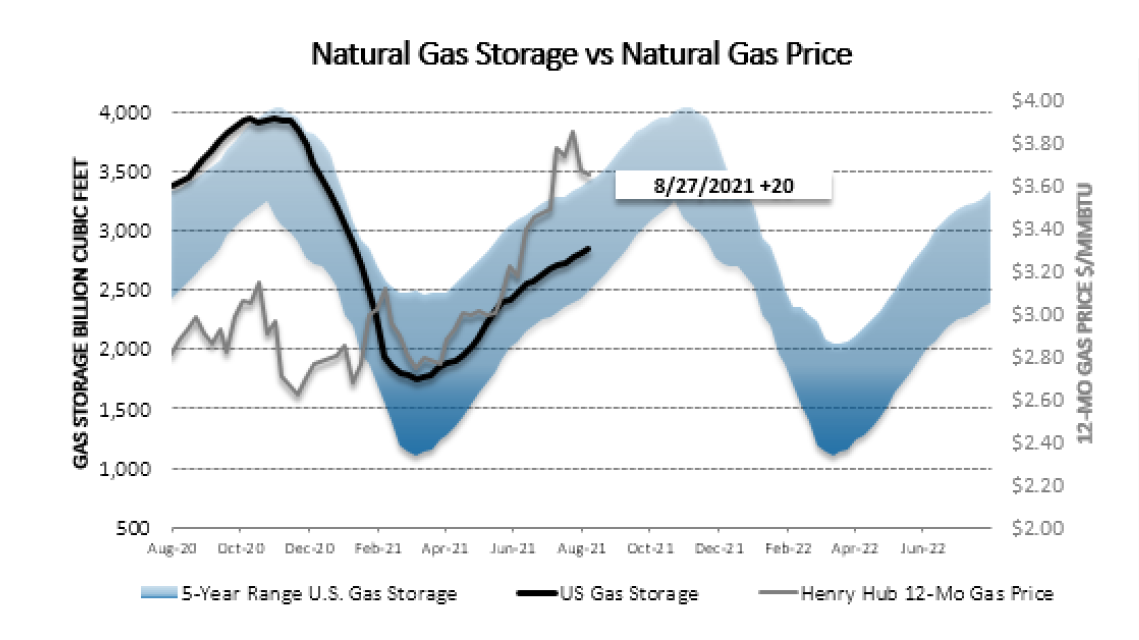

ERCOT Despite persistent strong loads and high temperatures, real-time prices, which have averaged around $40/MWh since last Friday, have remained relatively unimpressive throughout the summer. On the other hand, forward prices in the front of the curve continue their ascent on the heels of sustained strength in natural gas prices. Term prices in the front of the curve are up by $0.50-$1.50/MWh from last week, whereas prices post-CY23 range from being flat to being slightly down. Considerable backwardation remains between the 7x24 levels of CY22 and CY23 and beyond, currently around $8.00/MWh.

EAST Prices ticked up at the end of last week because of what was most likely the final heat-wave of the summer. Since the start of this week, the weather has cooled off, and so have prices. In ISONE’s Mass Hub, Day Ahead is averaging $52/MWh this week while Real Time is almost $5/MWh less. The trend is similar in MISO’s Indiana Hub, where Day Ahead is averaging $49/MWh and Real Time is $3/MWh lower. However, DART spreads have been minimal in PJM’s West Hub and NYISO’s Zone J (NYC), where prices are settling around $45/MWh and $50/MWh, respectively.