POWER MARKETS

WEST Multiple factors have tightened demand/supply conditions on the California grid and could lead to expensive Day-Ahead prices in CAISO over the next couple of days. On July 24th, a DC Transmission line (3,100 MW Capacity) went on outage, and is expected to remain out through Friday of this week— this line is a key source of imported power to California. Additionally, elevated temperatures throughout the West will push regional demand higher over the next few days. The Northwest and Northern California in particular will see above average heat — Portland and Sacra-mento are expected to see temperatures peak around 100 degrees. The CAISO is-sued a Flex Alert yesterday in an effort to reduce demand on the system.

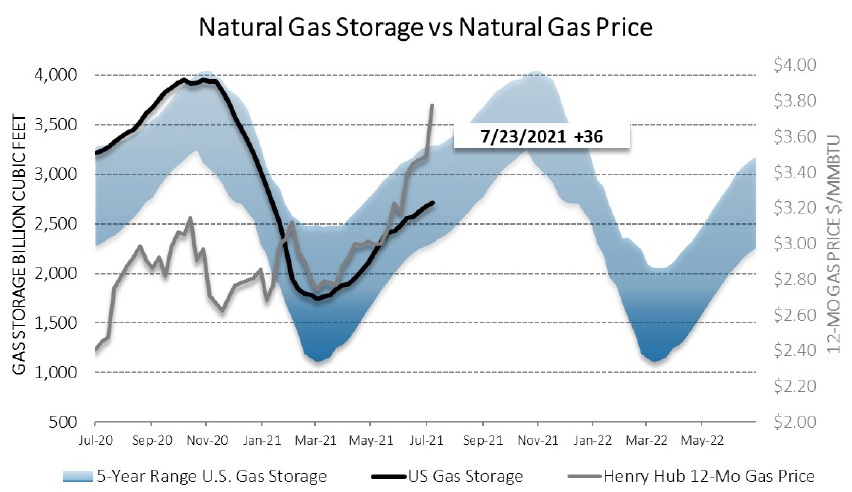

ERCOT Aside from some intermittent triple-digit pricing during peak intervals, real time pricing has settled in the low $30’s / MWh for the month. August may see more price volatility as it typically contains the highest CDD totals. However, drought con-ditions have eased and available generation is ample, potentially limiting real time price spikes in the short term. Meanwhile, term prices are mixed out the curve, with the continued strength in forward gas prices being somewhat offset by declines in the heat rates. The ORDC adder for this month is just over $0.30, which is not material.

EAST ISONE and NYISO have stayed relatively quiet this past week. PJM and MISO saw above average heat, prompting the CORE team to issue alerts Monday - Wednesday for PJM, and Monday - Thursday for MISO. The Tuesday PJM alert is expected to rank among the top 5 peaks of the summer— important for setting capacity tag obliga-tions in the region. Depending on today’s MISO demand, Wednesday may end up being the Summer peak for that region.