POWER MARKETS

WEST Over the course of July, the ATC Day Ahead LMP has averaged around $64/MWh and $50/MWh in SP15 and Mid-C, respectively. Demand in California has been elevated this week, peaking around 40,000 MW and resulting in upside during the nightly ramp, when prices have averaged around $145/MWh in SP15 from HE18 through HE21.

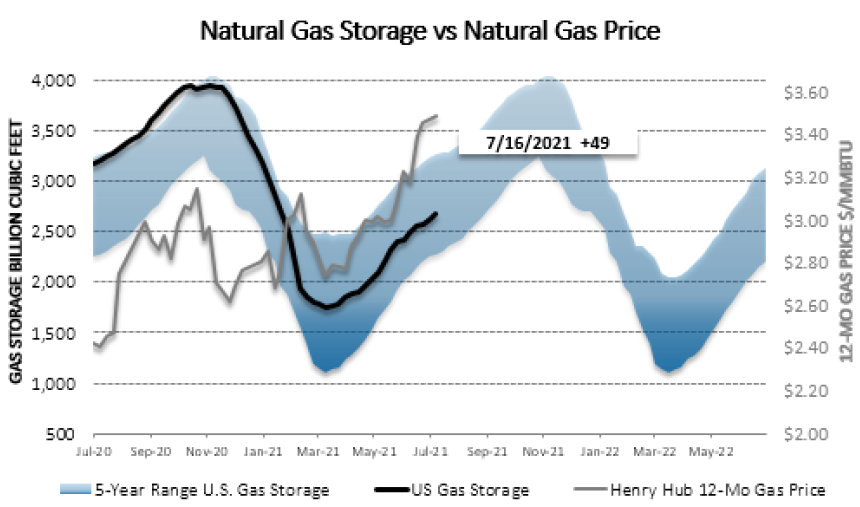

ERCOT Because of continuing mild weather and storms along the Gulf Coast, real-time prices have remained low for this time of year, averaging right around $30/MWh across all zones. However, warmer weather is anticipated over the weekend and early next week, and peak loads of 73,000-74,000 MW are accordingly expected for at least the first few days of next week. This projection is comparable to the record load of 74,820 MW set on August 12, 2019. Coupled with relatively low forecasted wind output, these higher loads will likely increase price volatility. Indeed, peak prices for the next three weeks are currently around $115-$130/MWh. Forward prices down the curve have also rallied from last week on the expected return of more normal temperatures and the ongoing rise in natural gas prices. Bal-21 7x24 prices are up by approximately $4/MWh since last week; the outer-curve strips are up by $1-$2/MWh. The front-year strips have made the largest moves.

EAST This week’s Day Ahead and Real Time prices are higher than last week’s but still rea-sonable for this time of year. In PJM’s West Hub, the Day Ahead average is $37/MWh, $0.70/MWh above Real Time. In MISO’s Indiana Hub, the Day Ahead average of $37/MWh is also higher than the Real Time average by $1.60/MWh. Day Ahead prices in ISO-NE’s Mass Hub are averaging $42/MWh while Real Time is averaging $0.85/MWh less. In NYISO’s Hudson Valley, the Day Ahead average is $43/MWh, greater than the Real Time average by $2.70/MWh.