POWER MARKETS

WEST The gas nominations taken last Friday by the gas-fired 1,100 MW Harquahala Generating Facility in Tonopah, Arizona—its first in more than three years—signaled much-needed extra capacity on the way to calm fears of shortages in the Desert South-west this summer. Also last Friday, CAISO, after reviewing its 2021 Summer Loads and Resources Assessment, stated that it expects supply conditions to be better this summer than in 2020, for roughly 2,000 MW of new resources, plus an additional 1,000-1,500 MW from expedited procurement, should be online. These developments together have had a very bearish impact on the Q3 2021 forward strip across all regions.

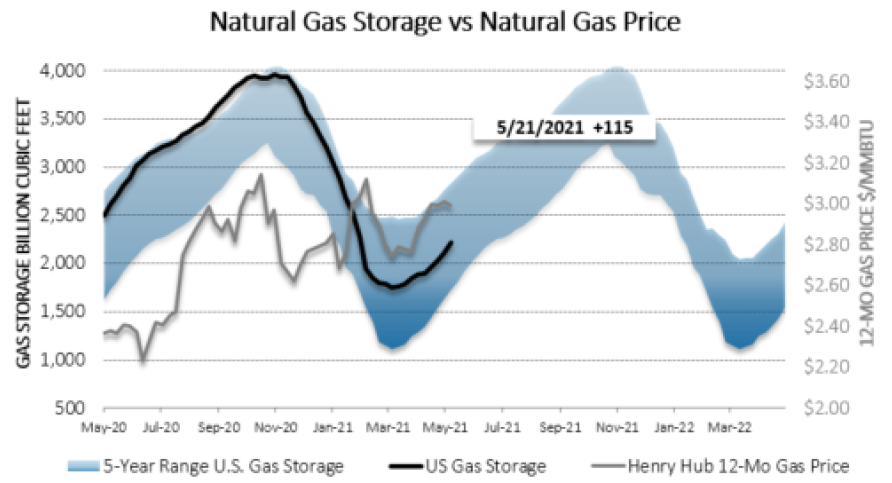

ERCOT The week has been relatively quiet for real-time prices as persistent rain has kept temperatures and loads down across most of the state. Real-time 7x24 prices have cleared in the mid-$20s/MWh in all load zones except the West, where they have aver-aged in the mid-$10s/MWh because of elevated wind output. The term market has also been rather calm as a slight decline in natural gas prices has offset the minor show of strength in heat rates to keep forward prices relatively flat down the curve since last week.

EAST As the weather has been warming up, so have prices. On average, Day Ahead is $4-$5/MWh higher than last week throughout the region with the exception of ISO-NE’s Mass Hub, where Day Ahead is only $1/MWh higher. Also trending up this week are Real Time prices, which are generally printing $5-$8/MWh above last week, although, again, they are only $1/MWh higher in Mass Hub. Regional DART spreads have been minimal with the exception of NYISO, where Real Time is higher than Day Ahead by $4/MWh in Hudson Valley and $5/MWh above Day Ahead in NYC.