POWER MARKETS

WEST Over the first half of May, the Day Ahead LMP has averaged around $30/MWh in both SP15 and Mid-C, and forward prices for Q3 2021 have continued to climb this week in both regions. In its 2021 Summer Loads and Resources Assessment, CAISO reaffirms the market sentiment of the last few months: The grid could encounter challenges in meeting demand during extreme heat waves.

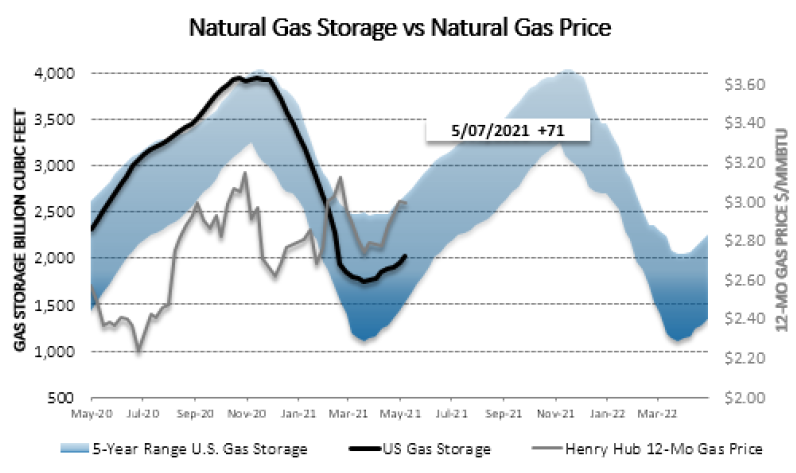

ERCOT Real-time prices averaging in the mid-$20s/MWh because of cooler weather across the state, this week has been relatively quiet. Congestion has helped prices clear more than $1/MWh over the hub in the North and Houston Load Zones, whereas the South Load Zone has been over by more than $3/MWh, typical for this time of year. Strong wind generation is projected for the next several days, so reserves are expected to remain over 20,000 MW for the next five days. In the term market, forward prices have been relatively flat from last week as lower summer peak heat rates have been offset by strong prices for other months due to the continuing rise in natural gas prices.

EAST As summer draws near, prices have been rather calm. Both Day Ahead and Real Time are settling in the $20s/MWh across the main hubs and are highest in MISO’s Indiana Hub, where Day Ahead is averaging $27/MWh and the Real Time average is $29/MWh this week. Both figures are around $23/MWh in ISO-NE’s Mass Hub and $24/MWh in NYISO’s Hudson Valley and NYC.