POWER MARKETS

WESTVolatility surrounding Q3 remains strong as the market has trended higher in response to the NOAA’s prediction of a hot summer. In addition, La Niña conditions in the Pacific Ocean have reduced regional precipitation to decrease the amount of flexible hydro generation available to both the Pacific Northwest and California during the summer. Com-pounding market anxieties, the recent retirements of the Boardman and Centralia (Unit 1) coal-fired power plants in the Pacific Northwest have further decreased the amount of baseload capacity in the region by 1,250 MW, increasing capacity concerns over the past month.

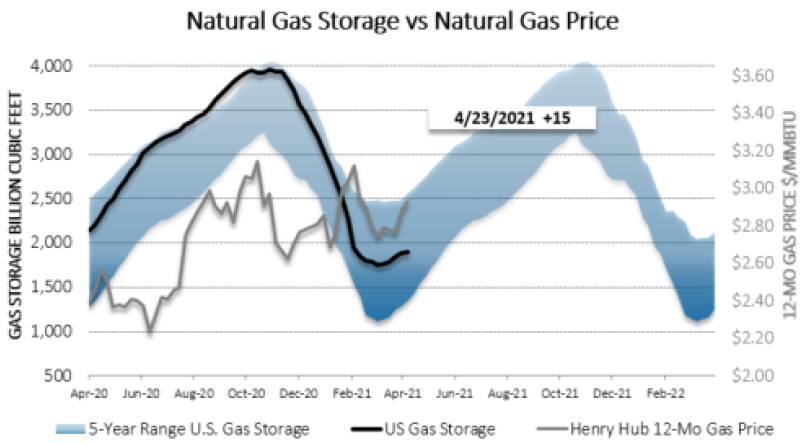

ERCOT Real-time 7x24 prices have dipped since last week and are averaging in the low $20s/MWh across all zones, thanks to strong wind output over most of the week plus the return of a few thousand MW of capacity from spring outages. With forecasted peak loads around 55,000 MW and approximately 20,000 MW of generating capacity still on outage, real-time prices could see a pickup in volatility toward the middle of next week, although projected wind generation looks healthy enough to keep reserves above 10,000 MW. For-ward prices have risen from last week on the heels of a continuing surge in natural gas prices and another jump in heat rates for this summer. Prices for Bal-21 have increased by more than $2.50/MWh; outer CY strips are up marginally by $0.25-$0.50/MWh.

EAST This week’s averages are practically identical to last week’s, ISO-NE’s Mass Hub, where both Day Ahead and Real Time are averaging about $4/MWh lower, being the lone exception. In PJM’s Dominion zone, strong demand in the middle of the week yielded a Real Time high of $550/MWh. The Real Time average for the week there is $51/MWh.